NC State’s ERM Initiative recently released their 2018 report on the State of Risk Oversight, which is very useful to see the progress (…or not) being made by organizations with enterprise risk management.

One of the sections in this year’s report studies the infrastructure of an ERM program, specifically a designated leader of risk, management-level risk committees, and board oversight of risk.

Let’s talk about each of these three areas…

Risk Management Leader

An interesting observation was made by NC State in this year’s report when they said:

Part of the challenge of ensuring that the risk management process is effectively integrated with strategy may be linked to the extent of executive leadership of the risk function. If risk management leaders are not at a level that is engaged in strategic planning, there may be a strategy and risk disconnect.

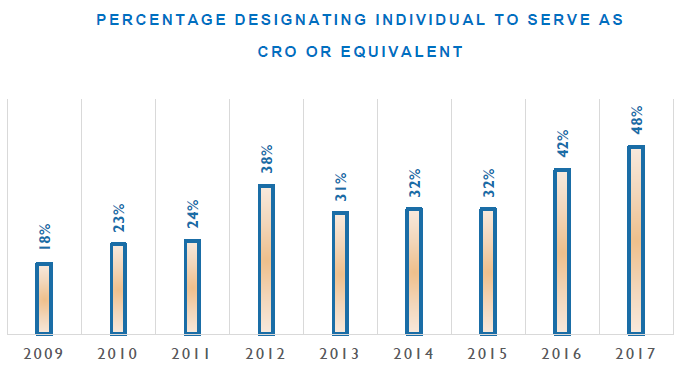

The idea of designating an executive to serve as a Chief Risk Officer (CRO) or similar role has really taken hold, with a 16% jump since 2015. (See the below chart from the report.)

Personally, I believe it is because executives are realizing that thinking about risk is a full-time job and cannot be done effectively as a part of another full-time role, like CFO or General Counsel. Of course, I am not saying that every organization should run out and appoint a CRO, but it would be a good consideration.

When it comes to Chief Risk Officers, a lot of people assume that this person focuses on managing the downside. Wrong! In reality, the CRO should be:

- Ensuring that the organization is taking the right amount of risk in order to achieve its objectives

- Encouraging discussions about risk and opportunity

- Promoting or cultivating a positive risk culture

- Integrating risk into various organization processes, like strategy, project management, procurement and vendor management, and business continuity.

They are the one with a seat at the table for impromptu risk discussions during executive meetings, providing the risk perspective, asking the hard questions, and ultimately supporting the final decision made by fellow executives.

You would expect to see a Chief Risk Officer at the larger companies with revenue of more than $1 billion, or financial services, or publicly traded companies, but even 46% of non-profits have a CRO!

The Chief Risk Officer is a vital role that can really take the idea of proper risk management and risk taking behavior and put it into action!

Management-Level Risk Committee

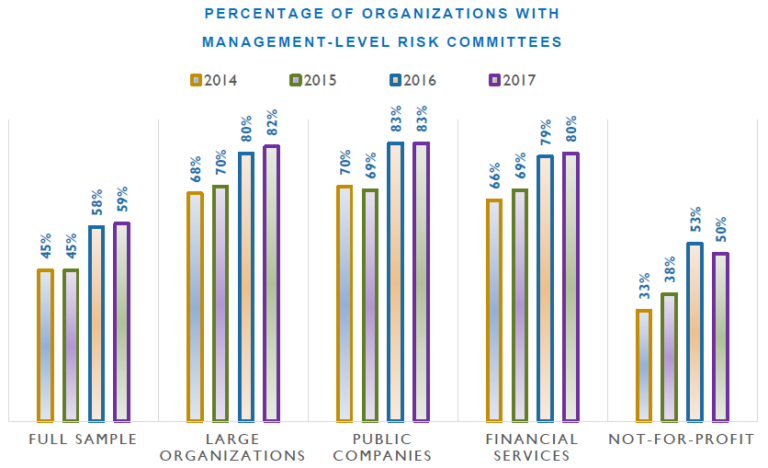

Organizations have definitely been seeing the advantages of a management-level risk committee, with 59% of responding organizations saying “yes” to this type of committee. In fact, since 2009, the percentage of organizations with a management-level risk committeehas grown tremendously from 22% in 2009 to 59% (yes, 59%!) in 2017. Of course, publicly traded and larger organizations have higher percentages (check out the below chart from the report), but half of the responding non-profits use them too.

There’s more than one reason why management-level risk committees are so popular…and effective.

- Having representation from multiple business areas makes the risk committee a cross-functional group, with each person able to provide their own perspective on risk and bring their expertise to the table.

- The involvement of these individuals increases the engagement of the organization and support a positive risk culture.

- Committees can be focused on specific types of risks, like financial risk, IT, etc., which can ensure progress is being made in the right direction.

Here is a real-life example of how committees can be useful:

I spoke with an ERM leader who was struggling with engaging the executive team in the ERM process in their role as Risk Committee. The executives were too busy and could not dedicate the time and focus needed for the program to move forward and mature.

Essentially, ERM was going nowhere because the executives were not engaged.

I recommended that the existing Risk Committee be disbanded.

Yes, disbanded.

But the executives should identify delegate(s) to represent their area(s) and form a working group level to get actions accomplished.

In a recent follow-up to our conversation, these changes were successfully presented to the audit committee to move forward and the executives completely bought into this idea. Separate cross-functional ERM working groups are being formed to tackle specific areas of risk.

Accountability can still exist even in groups because the groups are not replacing risk ownership.

Risk Oversight by the Board

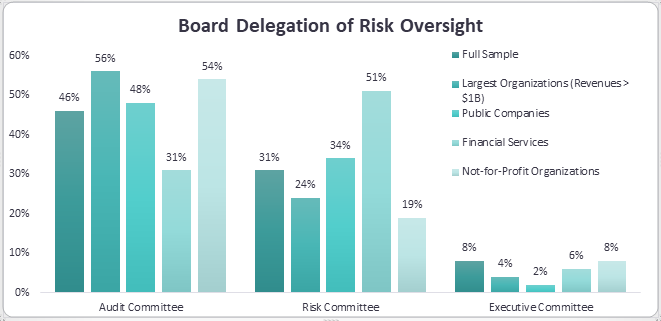

Regulators and other supporters of corporate governance (not to mention the public) are holding board members more accountable and responsible for proper oversight of risk in the organization. In other words, “I thought we were managing that risk” is not enough now.

However, a lot of boards have delegated that responsibility, as shown in this year’s State of Risk Oversight report, to a board committee – 57% to be precise. But which committee? The Audit Committee was the primary choice, followed by a board-level risk committee, and last, the executive committee. (See the below image for the breakdown.)

This delegation includes oversight of management’s risk assessment and risk management processes.

Based on my experiences and observations, audit committees tend to focus on risks associated with audit reports and financial risk, mainly because those areas are their comfort zone.

But is that the best way to do it?

Not in my opinion.

I would suggest actually splitting the communication of risk information in the following way:

Reporting to the Designated Board Committee:

- Updates on implementation of ERM

- Maturity steps in the ERM process, such as integration efforts, development of KRIs, etc.

- Top Risk status updates and deep-dives as requested

Reporting to the full Board:

- Information related to the actual management of risk, including risks being accepted and risk deliberately and thoughtfully being taken to achieve a specific objective

- Risks identified during strategy development and how they are being handled

(Note: the reporting to the full board should be included as part of the business discussions with the board, not as a separate risk report.)

When it comes to the working infrastructure of an ERM program, there are a lot of moving parts. All three elements discussed are extremely helpful for ERM to succeed. However, as I have said over and over again, every organization is different, and the ERM program has to be tailored to the needs, leadership, and culture of that organization.

I look forward to seeing how organizations move their ERM programs and processes forward as they adopt new or different practices.

Is your ERM infrastructure working effectively and efficiently?

Please comment below or join the conversation on LinkedIn.

If your ERM program is stuck in neutral and needs a boost to get moving again, contact me to discuss how you can get a tailored action plan to achieve your ERM goals.

Featured image courtesy of Evening_tao via Freepik.com