If there’s one thing I have come to appreciate in my life, it’s how there can be so many perspectives and wildly differing opinions around a given topic, be it politics, religion, sports, or even something as inane road maintenance in a neighborhood association (don’t ask!).

In the risk management world, few other topic garners more controversy and passionate debate than risk appetite. Opinions on this tool vary more than the weather, with one extreme like this comment from Jack Kruf who says risk appetite is “…an invented concept in my view and not rational” to COSO saying that “at its core, risk appetite is critical to an organization’s success.”

How is anyone supposed to make sense of this concept when there are so many differing opinions?

One place I enjoy seeing a wide array of perspectives on any ERM-related topic is in the comments section on Norman Marks’ blog where he garners commentary from risk thought leaders from around the world. As you can imagine, his articles on risk appetite in particular generate much buzz, with many of the comments constituting an article in their own right!

A comment by John Fraser to one of Norman’s articles on this topic particularly caught my attention.

One point I mention in my foundational article on the fundamentals of risk appetite is how many companies see it as a “check-the-box” activity to satisfy auditors and regulators. Instead of it being a tool for helping the company make risk-informed decisions and achieve its goals, risk appetite is seen as this generic statement(s) that figuratively (…or maybe literally) gets put on a shelf and never used again.

John’s comment prompted me to view this challenge in a different light and determine a solution that, in my opinion, bridges the gap between the two extremes of risk appetite.

I’m going to break John’s comment up so we can better understand how risk professionals can help their organizations address this vexing challenge of developing a risk appetite that has at least some use for decision-making.

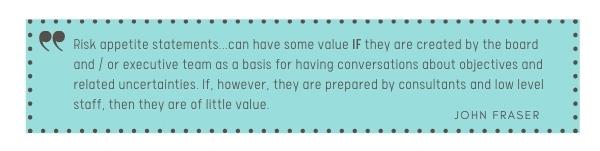

The first part of the comment I want zero in on discusses who is responsible for developing this guidance. John explains… Totally agree!

Totally agree!

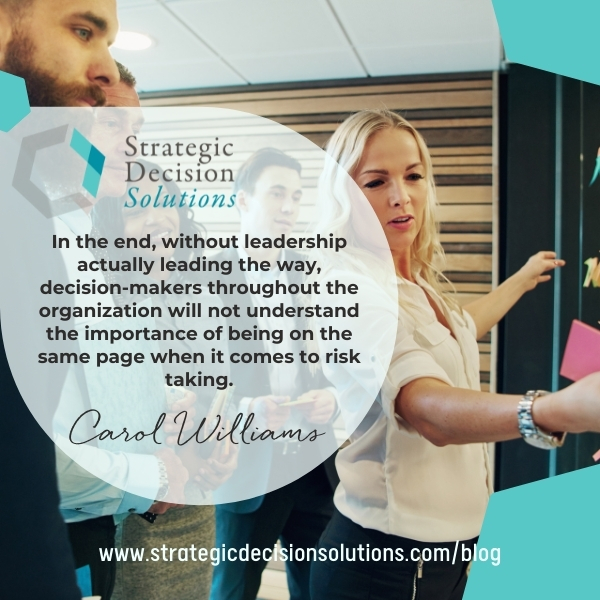

In order to develop risk appetite statements that actually play some kind of role in managing the company, they must come from leadership. An informal survey of risk professionals I ran a few years ago shows a lack of leadership and the proper “tone at the top” as the #1 challenge to implementing ERM.

In the end, without leadership actually leading the way, decision-makers throughout the organization will not understand the importance of being on the same page when it comes to risk taking.

Take an exploratory call with a potential client as an example…

When speaking with director-level personnel, I asked them to rank on a 1-5 scale their company’s level of risk taking, with 1 being extremely risk averse while 5 representing a much higher risk-taking stance.

Their answer? Right in the middle at 2.5.

And when speaking with the COO, what was his answer? He ranked the company’s risk taking at a 3.5.

Therefore, the COO is more of a risk taker than other individuals in the organization, creating a disconnect between himself and his support staff who may be making decisions that don’t reflect the company’s preferred level of risk taking in pursuit of objectives.

Over the years, I have found this simple tool to be an easy way to “check the pulse” about the company’s risk culture. I can then use this information to facilitate leadership’s development of risk appetites around varying types of risks and opportunities. (Note that my team of consultants do not create the statements ourselves…we always heavily lean on the leadership’s input and perspectives.)

Whether we’re talking about external resources like me or an internal risk and strategy consultant, it’s okay to ask questions and gather information to help executives and the board craft their preferred level of risk they are willing to take in pursuit of strategic goals.

However, they have to carry it the final mile when comes time to actually put pen to paper.

Next, John explains how…

This remark illustrates the extent of the issue of risk appetite being created, but then kept locked up to a very small group due to the kind of information contained in the statements.

Many executives are under the impression that the risk appetite statements will give away a company’s competitive advantage. But what they are missing is that the company’s strategic plan and related initiatives are the secret to the competitive advantage.

If the company trusts its strategic plan to the employees, why shouldn’t those same employees understand criteria for making a go/no go decision?

However, before you share risk appetite information with your employees, make sure to finish reading this article and taking the recommended steps below.

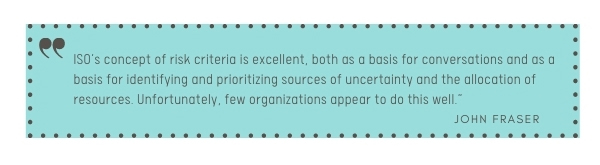

John wraps up his comment by explaining… One common misconception is that risk appetite can be an all-purpose tool. While different iterations of risk appetite can be used for multiple purposes, there needs to be clarity around what it will be used for. What often happens is a company will dive right in and try to develop extensive risk appetite statements when they are not ready for that.

One common misconception is that risk appetite can be an all-purpose tool. While different iterations of risk appetite can be used for multiple purposes, there needs to be clarity around what it will be used for. What often happens is a company will dive right in and try to develop extensive risk appetite statements when they are not ready for that.

Keeping them high level can be a great start for ensuring everyone in the organization is on the same page when it comes to the level of risk the company is willing to take in pursuit of objectives.

However, keeping risk appetite at this high of a level will not make it helpful for guiding strategic decisions. In Enterprise Risk Management: Today’s Leading Research and Best Practices for Tomorrow’s Executives, a book which John Fraser co-authored, consultant and former executive and ERM Director Rob Quail explains:

Providing ‘naked’ objectives isn’t enough to allow these employees to understand the limits of their decision making or the intended behaviors they should be exhibiting day-to-day. They need to know what risk or uncertainty the company will accept, relative to those objectives, in the overall pursuit of value.”

Therefore, if risk appetite is going to be used as a business prioritization tool, it needs to be accessible to all levels of the organization responsible for making decisions in pursuit of strategic goals or running the business.

I’m afraid this isn’t something that’s black and white as risk appetite will depend on a host of factors unique to your organization. As the National Association of Corporate Directors admits:

…there are no standard or regulated components of formats for a risk appetite statement.”

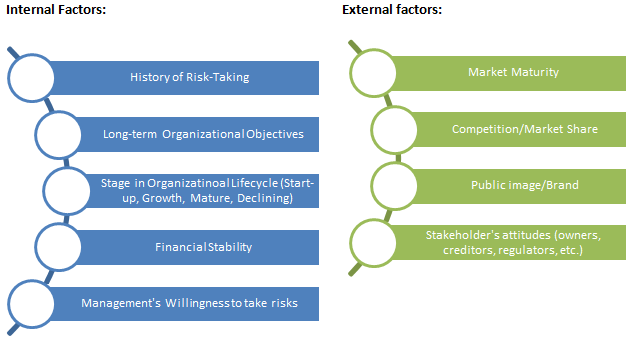

In the end, it really depends on your organization’s intended use of risk appetite as explained in the previous sections. This article on establishing an ERM program discusses some basic elements of risk appetite, including the following internal and external factors that can affect it.

Again, while statements will vary from one company to the next, my previous article exploring the fundamentals of risk appetite include some samples to give you an idea.

But before doing anything, I ask this fundamental question – a risk is here; are we okay with that?

Sometimes it’s very black and white, so nothing formal is needed.

But I agree with John, and if I’m understanding him correctly, he falls somewhere in the middle of this great divide like myself. If done poorly, risk appetite is not useful at all. But with a bit of experimentation and the proper perspective, these statements can be useful tools for at least getting everyone on the same page, and in the long run, helping guide risk taking in pursuit of strategic goals and prioritizing people and money resources.

How does your company approach risk appetite? Do you feel it can be helpful or has it proven to be too cumbersome?

Like so many topics, risk appetite is one of those concepts that requires you to consider an array of perspectives to arrive at a workable solution for a particular situation. To share your perspective on this dynamic (and often explosive) topic, please feel free to leave a comment below or join the conversation on LinkedIn.

And if you are struggling to help executives articulate an actionable risk appetite for risks and opportunities facing your company, please don’t hesitate to schedule a meeting to discuss your specific challenge today!