In response to the coronavirus pandemic, companies are having to make hard choices on how to survive and thrive through this uncertain time. Instead of taking time to consider potential impacts of their options, too many companies are taking a very reactive approach to their decision-making.

The book Decision Quality: Value Creation from Better Business Decisions provides some clues as to why when it says:

The human mind simply isn’t wired to achieve Decision Quality (DQ) in a natural, intuitive way. Because of how our minds work, mental traps and biases frequently get between our best intentions and true decision quality.

Reacting to events or issues instead of proactively identifying threats and opportunities to strategic objectives is a distinct contrast between traditional risk management and ERM.

Although the consequences of a reactive decision-making approach to the current crisis will not be immediately apparent, we do have some idea of what can happen to companies who take this sort of “rear-view” approach. At best, executives, managers, and support staff are always in scramble mode putting out fires instead of working to achieve objectives.

And at worst, the company could fail altogether.

Rather than just reacting and going on a “gut feeling,” management needs tools for making informed decisions quickly…

Going back to the basics for a moment, while we may call it ERM, the fact is that risk management is just good management. ERM is a proactive, structured, and continuous approach that helps an organization get out in front of risk(s) or seize opportunities to achieving objectives.

In the context of decision-making in response to the pandemic, executives and managers must consider both dependencies (upstream) and consequences (downstream) instead of just thinking about the immediate need.

To elaborate a little more, when evaluating how to address a need, executives have to consider what must happen first in order to address the need – this is the upstream.

Considering what needs to happen to address the need is only half the equation though…

Good decision-making also requires executives to consider other areas that could be impacted…will a particular course of action lead to new risks that could be more devastating?

Take Zoom for example…

Because of the surge in remote work in the last couple months, many companies are now using this popular video conferencing tool. While rushing to this tool may address the immediate need, improper setup and use could trigger IT or legal risks. This example is especially relevant considering recent security issues where hackers can take control of webcams or blast offensive content during a meeting.

As Norman Marks explained in his book Making Business Sense of Technology Risk:

IT (or technology) related risk is business risk…It consists of technology-related events or situations that could potentially impact the business and its success.

Another example is something many companies are struggling with right now – finances.

Due to a steep drop in revenue, many are trying to determine how they will stay afloat. The short-term solution is to plug any holes – what services or subscriptions are being under-utilized or not utilized at all?

Once this low-hanging fruit has been picked through, the company has to start making harder choices.

One company I recently spoke with was taking a very haphazard approach to its decision-making during the pandemic. They are opting for significant pay cuts and layoffs instead of looking at other ways to save money, such as delaying system upgrades. Could the downstream consequences of this decision be even more devastating? If people leave (…either by their own choice or because of a layoff), the company loses the skill sets and knowledge base needed to innovate and serve clients/customers. When things pick back up again, will the company be able to offer the same level of service as before?

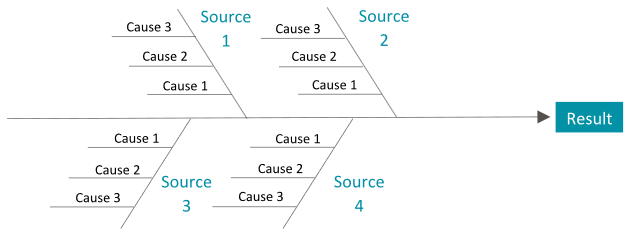

When considering upstream dependencies and downstream consequences, visual tools can be especially helpful for prompting ideas on solutions.

One such example is a fishbone diagram…

Although commonly used to understand the root cause of a risk or issue, they can be adapted to determine dependencies of a particular need. Fishbone diagrams can be as simple or as complex as they need to be. Below are a couple of examples from a previous article on root cause analysis.

Just remember – the fishbone diagram is just one of many tools to help you and executives visualize dependencies and consequences. With a little trial and error, you should determine which visual tool works best for your organization.

Convincing executives to think about the big picture and not just the next week…

Executives are under a lot of pressure right now to make quick decisions. However, it’s vital that they don’t make rash decisions that are detrimental to the organization.

What can you be doing right now to help executives in their decision-making?

In a recent article, Norman Marks describes how risk managers should approach executives when he says:

…we should change from what I call (in Lean terminology) a ‘push’ approach to one that is more of a ‘pull’ approach. What I mean is that we should figure out what the organization needs from us if they are to be successful, and then deliver it (pull) – instead of doing what we think is right (based on industry or professional standards) and hoping once we push it at them they will see some value.

Whatever solutions you provide, they must NOT be bureaucratic first and foremost. They should not add any additional paperwork to an already overloaded leadership team.

One possibility is to develop a simple list of questions – a cheat sheet that executives and managers can refer to when faced with a decision. A couple of example questions can include:

- What is the tradeoff between the immediate and long-term? How will this decision affect our long-term survival and success?

- What are adjacent issues connected to this decision? Could we be creating new risks to the organization?

What questions would you add to this list?

To share your thoughts, join the conversation on LinkedIn.

Sound decision-making is more critical now than ever. If your company is struggling to take a more proactive approach to this situation and, more broadly, the identification of threats and opportunities to achieving strategic objectives, please reach out to me to discuss your situation and brainstorm potential solutions today!

Featured image courtesy of Jim Reardan via Unsplash.com