As a former regulator of property & casualty insurance companies in Florida, I can appreciate the importance of some regulation of certain companies. After all, you don’t want to find out after a hurricane that your insurance carrier is insolvent.

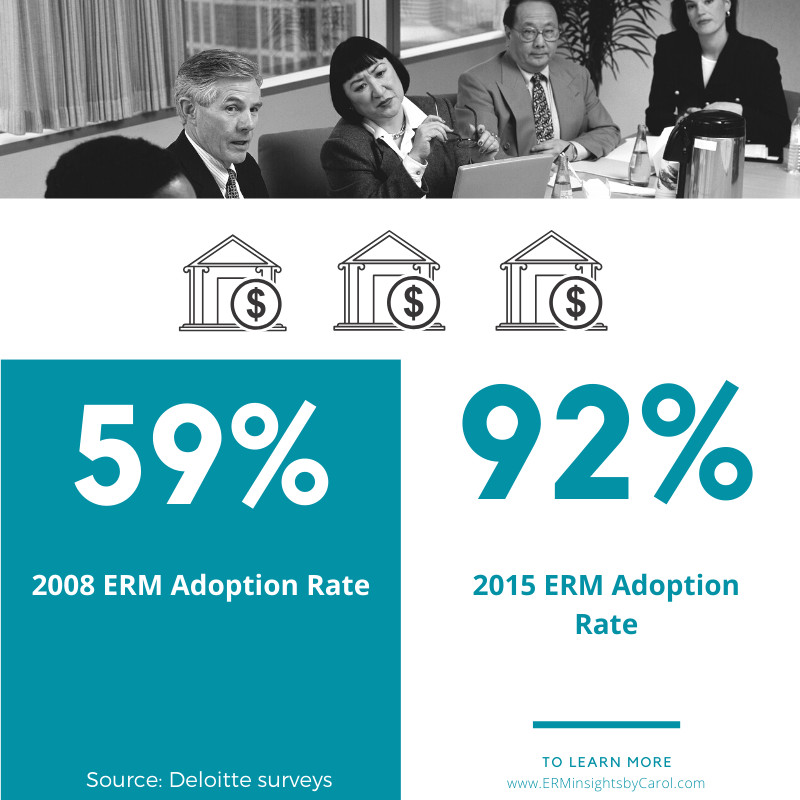

Risk management related regulations like ORSA for insurance companies, Basel III for banks, and some publicly traded firms are relatively new. However, the extent of the regulations has had a significant impact on the number of companies adopting ERM. According to one Deloitte survey of risk management in large banks, 59% of respondents had ERM in 2008.

By 2015, this number stood at 92%!!!

Despite this growth, companies who have ERM because of a regulatory requirement rarely realize any added value to the enterprise. As Norman Marks explains in his book World Class Risk Management:

….when risk management is implemented in response to regulation, it becomes a cost of doing business instead of a way to do business more effectively.

To explain it a different way, it becomes enterprise list management instead of enterprise risk management. Why the focus on lists of information?

Regulators typically have an audit mindset and only understand ERM from a formal, yet outdated perspective.

Regulators, whether they are at the state-level or an international body like the Bank for International Settlements, are typically going to approach ERM with an “audit” mindset. They are going to focus more on the volume of risks and whether the company is taking too much risk, not about the company achieving its potential.

When examining a company’s ERM process, a regulator’s main priority is to ensure executives are thinking about the biggest risks to the company. As you may be able to tell, their main interest is managing negative risks – is the company maintaining a list of these risks and what are they doing about them?

Once the regulator is satisfied with the volume of risks, they will then look for documentation on assessment and risk controls. Some questions they may ask include:

- Where is your risk register?

- Where are all of your risk assessments?

- Have there been any audits of risk controls?

- How have you followed up with business units?

- Where is your documentation of those follow-ups?

While questions like these lead you in the direction of enterprise list management, this is not what executives need to make informed decisions.

And while regulators mainly focus on the volume of risks, the reality is no company will be able to identify every single risk. If they did, they would manage themselves right out of business.

Also from Norman Marks, this time on his blog:

A periodic assessment and review of risks is not effective risk management. It just enables management to say that they have ticked the risk management box.

Although a regulator may not understand this, any executive knows that a company has to take risks in order to be successful.

And as I discuss in my article comparing traditional risk management and ERM, companies who only focus on avoiding risks and preventing failure will not be successful in the long run.

So how can a company comply with regulatory requirements and prevent itself from falling into the enterprise list management trap?

According to 79% of respondents to a 2015 Deloitte survey, complying with regulations is the greatest challenge to risk management.

Perhaps due to the nature of their work, regulators are very comfortable with the idea of companies doing things a certain way…they often don’t recognize there is more than one way to do something. A key mantra of ERM is that in order for it to provide value, it must be tailored to the company’s needs and culture. In the end, regulators cannot expect the same thing out of every single company.

What regulators are looking for is documentation of risks and what’s being done to address them. Assurances from executives are often times insufficient and, depending the company or executive, suspect.

To address regulators concerns without descending into enterprise list management of negative risks, companies should document the outcome of a decision and what the company is doing to address risk around this decision.

In other words, you don’t have to make notes on every single risky possibility, scenario, and assessment that gets conducted as you move towards making a strategic decision. Who has the time?! And who wants to actually do that?! (I know I don’t.) Rather, focus on the end result, describe why management has decided to take action (or not) about it, and what is being done.

A possible way to describe the outcome is this: the likely scenario of [describe scenario] could prevent our company from achieving XYZ strategic goal, which is vitally important for the company to grow over the next 3 years. Therefore, we are going to focus on action 1, which will ensure consistency across the company’s messaging, while at the same time action 2, increasing efficiencies across the company’s workforce.

Complying with regulations is like walking a tight rope, especially when it comes to discussing risks. You want to share just enough to satisfy requirements without prompting additional questions from the regulator. On the flip side, you don’t want to share too much because this will prompt questions too.

You have to find the right balance…

What was the main reason your company began ERM?

How have you been able to comply with regulatory requirements while maintaining an ERM process that helps executives make risk-informed decisions?

Share your thoughts on this important topic by leaving a comment below or joining the conversation on LinkedIn.

And if you feel regulators are simply pushing your company into enterprise list management instead of enterprise risk management, my experience on both sides of the table could be extremely helpful. I invite you to reach out to me to discuss your specific situation today!