In the waning years of the 2010s, the term “fourth industrial revolution” is becoming a commonly heard phrase for describing the nature and pace of technological change expected to take place in the decades ahead. Other terms to describe this include cyber or digital revolution.

What makes this revolution unique is that it not only could impact what we do, but who we humans are as a species. Whatever you want to call it, it will be a massively disruptive force expected to impact all disciplines, industries, and economies.

The phrase “fourth industrial revolution” was coined by Klaus Schwab of the World Economic Forum, who explains:

The future combination of big data, smart technologies, and integrated cyber systems is going to transform our existence [emphasis added] at every level, creating opportunities (and threats) that were once unimaginable.

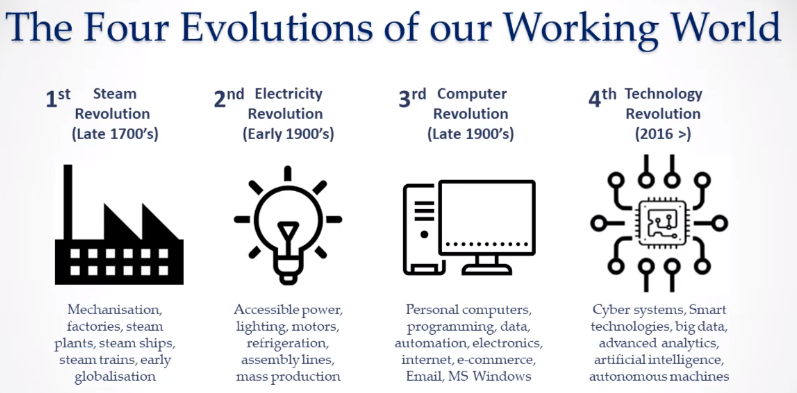

How this revolution will impact the risk management profession was the topic of a presentation by Warren Black at the recent Risk Awareness Week online summit. Black is a scholar and consultant based in Australia with both an engineering and risk background. In the beginning of his presentation, he explains how the fourth industrial revolution could be the bigger than the three that preceded it in the last 250 years.

Consider this…

Following the invention of the telephone in the mid-1870s, it took nearly 70 years for it to grow to 100 million users.

Fast forwarding to the 21st century, Facebook achieved this milestone in just five years and the popular game Candy Crush achieved it in just three!!

It’s amazing (…and a little scary) to consider that start-ups in the years ahead could attract this number of customers in less than a year. In other words, an organization today could face massive disruption from a competitor that doesn’t even exist yet.

Risk management as a discipline will not be immune to this disruption…

Like previous eras, the fourth industrial revolution will cause massive disruption of most standardized and repeatable tasks.

Black explains how these repetitive and standardized tasks were disrupted in prior industrial revolutions. Risk management specifically has numerous tasks that fit this description…tasks like audits, risk reports, and risk analysis are at high risk of disruption by SMART technologies, artificial intelligence, and advanced robotics.

Technology, whether in prior eras or our current time, was not developed to improve existing methods, but instead to remove the most remedial and repeatable of processes. Black uses the following saying to make his point…

Electricity wasn’t invented to improve the performance of the candle.

What this means is that new risk management-specific technology isn’t being designed to improve existing methods, but instead to make it where we don’t have to do them that way again.

He explains how this is a fundamental characteristic of all industrial revolutions – to replace the most repeatable tasks with technology.

How will risk management need to adapt to remain relevant in the decades ahead?

The answer to this question is not entirely clear. However, according to Black, a few obvious areas where modern organizations will need to begin planning now include:

1. Cyber-enhanced risk management – advanced analytics, information sharing, and real-time data has massive potential for how risk professionals understand, document, assess, treat, monitor, and even report risks. Technologies like 3D hologram mapping and Wikipedia style systems are already in development that could make existing processes redundant.

2. Complex systems thinking – it’s no secret that the world of work is getting more systemically complex. Therefore, complexity management and systems thinking will become a core risk management skill in the years ahead.

3. Natural (Systemic) Resilience – being able to respond positively and intelligently to change is the mark of resilience. Understanding and mimicking the resilience of natural systems like the Amazon or the human immune system can help organizations better adapt to constant change.

4. Protecting Shifting Value Drivers – this is a big one since a company’s value is changing from the tangible to the intangible. Traditional risk management efforts have focused on protecting physical assets and people. But as I mention in this previous article on reputation risk, an organization’s value is increasingly driven by intangible assets like reputation and others. Take Instagram as an example – although the company only had 13 employees and $250k in physical assets, it was sold to Facebook for $1.3 billion.

In short, risk management MUST adapt from tangible assets like people, products, and equipment to intangible assets like reputation, trademarks, intellectual property, and more.

Sadly, many organizations are not preparing for or investing in the technologies of the future. As the World Economic Forum states in its 2019 Global Risk Report, few organizations are investing in “…the risk management infrastructure necessary to respond positively to emerging global threats.”

In short, they are “sleepwalking into crisis.”

Black explains the best thing risk management professionals can do is to develop a risk transformation plan for their organization. If they are to survive, modern organizations must start “…visualizing, planning, and upskilling.”

What we consider commonplace today will almost certainly change in a fundamental way in the decades ahead due to a combination of big data, SMART technologies, and complex cyber systems.

This presentation reinforces the fact that the speed at which the world changes will only accelerate as time goes on. And it makes plain the fact that risk management professionals need to focus on more soft skills in addition to the typical “risk process” topics of risk assessment and risk reporting.

Is your organization making the necessary preparations to prevent disruption from technological change?

Please don’t hesitate to share your thoughts on the Fourth Industrial Revolution and how it will impact the risk management discipline by leaving a comment below or joining the conversation on LinkedIn.

If your organization is struggling with how it can adapt to this change to survive and thrive, contact me today to discuss your specific situation.