Soon after COVID-19 began affecting the U.S. last March, I spotted a brief article on LinkedIn from Hans Læssøe explaining how the pandemic was not a “black swan” event as some were saying but rather a “gray-rhino.”

As you may know, a “black swan” is an unforeseen, improbable event, be it positive or negative, which causes drastic consequences. A book by the same title by Nassim Taleb explores this concept in-depth.

While I found Hans’ observations interesting, I set it aside amidst the chaos we were experiencing at the time. Our son’s school was transitioning to at-home instruction, my husband was away tending to his mom in the hospital (not related to COVID), and I was focused on both maintaining my commitments and responsibilities as an ERM consultant and being a teacher and mom to a 5 year old.

The point of Hans’ article was that the pandemic was not unforeseen as many were saying. Pandemics have happened in the past, and warning bells were ringing of the possibility of another.

Therefore, COVID-19 was what should be called a “gray-rhino” event.

A gray-rhino is essentially an event we know is possible but choose to ignore…the only uncertainty is when and how the event will occur.

The term gray-rhino was coined by journalist, author, former non-profit executive, and founder of The Gray-Rhino Company, Michele Wucker.

In a 2018 interview with the Financial Times’ Alphachat podcast, Wucker explains:

The gray-rhino is a metaphor for the obvious things coming at us that are dynamic that don’t get nearly as much attention as we think they ought to. We don’t pay enough attention to how bad we are at dealing with what’s right in front of us.

She goes on to explain that the gray-rhino is different than the “elephant in the room” because in the case of the former, it is something we do talk about instead of just ignoring outright as in the latter.

Take COVID-19 as an example.

The possibility of a pandemic was something plenty of people were talking about casually but with no sense of urgency. I include myself in this group…if you were to ask me about the risk of a pandemic at the beginning of 2020, I would have probably dismissed it in all honesty..

Could the possibility of higher price “inflation” in 2021 and beyond be considered a gray-rhino?

In my (non-expert) opinion, the answer is yes. While many observers believe in the real possibility of higher inflation this year, it hasn’t been top of mind for most in the business world or at the personal level.

So why do I think inflation will become an issue in 2021 and beyond?

At the onset of the pandemic, governments and central banks around the world began flooding their economies with money in an effort to stave off a complete collapse. Here in the U.S., Congress passed the $3+ trillion CARES Act and the Federal Reserve injected liquidity into equity markets. One provision of the CARES Act provided cash payments to Americans along with loan guarantees and outright subsidies to corporations and businesses.

In an article on Bloomberg, Roger Burgess explains the aggregate money supply of the U.S., China, Eurozone, Japan, and eight other developed economies exploded by an eye-popping $14 trillion in 2020. The U.S. central bank for example is currently injecting $120 billion a month into financial markets through its purchase of fixed-income assets.

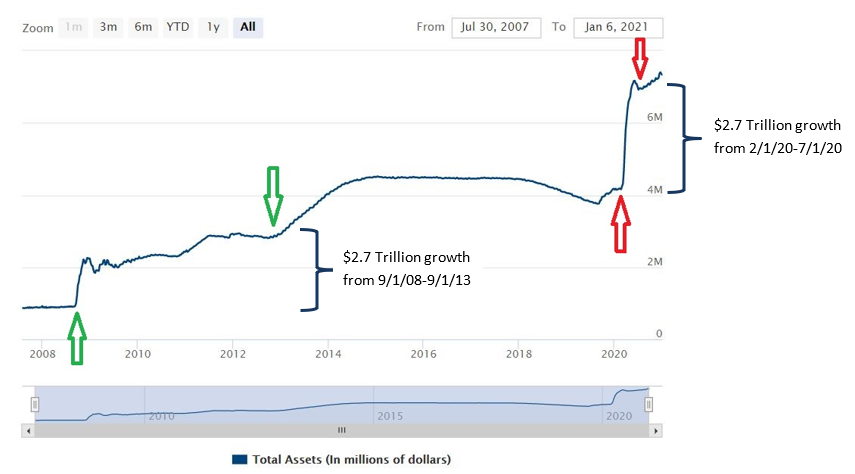

This comes on the heels of huge liquidity injections by central banks in response to the 2008-09 financial crisis.

To illustrate the magnitude of actions taken in 2020, it took five years for the Federal Reserve balance sheet to grow by $2.7 trillion following the 08/09 crisis…at the onset of the pandemic, it grew by that amount in just five months!

Whether these moves were advisable or necessary can be debated…the point is what impacts will these actions have on inflation.

The prospect of higher price inflation in 2021 and beyond is a concern being echoed by many, including Fed chairman Jerome Powell. In September, Powell spearheaded the Federal Reserve system to change to an “average inflation targeting” approach, which means the central bank will allow price inflation to run higher than their historic target of 2% before adjusting interest rates to tame it down.

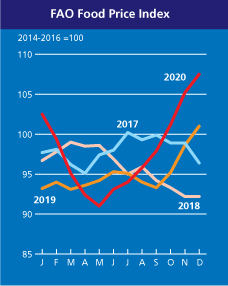

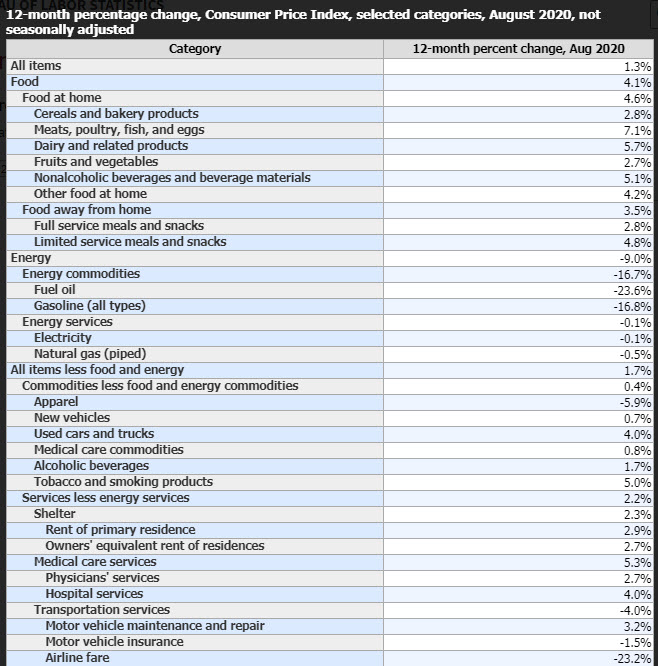

Now 2% may not seem all that bad, but remember that official inflation numbers factor in everything. But upon closer examination, we can see that while prices for airline tickets are down sharply, the prices for staples like food are rising rapidly as the following charts illustrate…

Predictions on where inflation will go run the spectrum. On one extreme, central bank actions could lead to hyperinflation while the other extreme maintains that inflation isn’t an issue because of the deep recession we are experiencing.

As the top economist from the Council on Foreign Relations explains, neither of these is correct. While we can expect the Fed’s target of 2% to be hit pretty soon into 2021, he is not expecting a catastrophic hyperinflationary scenario either.

One observer in line with this thinking, Robert Wenzel, editor of Economic Policy Journal, believes we can expect 3% inflation in 2021 at a minimum but 5% is a real possibility. When considering the real prospect of additional stimulus and the expected resumption of travel and other activities through this year though, he believes 10% inflation by the end of 2022 is possible.

What does this mean for your organization?

The honest answer is it depends…

Circling back to Michele Wucker, we have three choices when a gray-rhino is charging at us, which are…

- Get trammeled

- Get out of the way

- Use the strengths of the rhino to your advantage

The third one is very interesting, especially in light of commentary on this blog and elsewhere on the importance of taking informed risks in pursuit of strategic objectives.

Therefore, the question you need to ask is – how will accelerating price inflation (…or other potential gray-rhinos) affect my organization? Is there any way we can use it to our advantage?

The goal of this article is to provide you with thoughts and observations to prompt you to think more (and act!) about gray-rhinos.

How do you think accelerating price inflation will affect you personally or your organization?

What other gray-rhino scenarios do you see out there?

As always, we are interested in your thoughts, so please don’t hesitate to leave a comment below or join the conversation on LinkedIn.

Let us know what you think. Do you want us to discuss concepts like the gray rhino and black swan more in the year ahead?

And if your organization is struggling to understand how it can better take informed risks to not just survive but thrive in today’s ever-changing world, reach out to discuss your specific goals, needs, and situation today.