I don’t think it’s an understatement or cliché to say that the uncertainty gripping today’s business environment and overall economy is thick enough to cut with a knife.

With inflation still stubbornly high and the odds of a recession increasing dramatically in recent months, companies are once again considering how to best navigate choppy waters.

Sadly, like during the onset of the COVID-19 pandemic, many companies simply take a metaphorical chain saw to their budgets at the first signs of difficulty in an effort to preserve as much cash as possible.

(Side note: I am not saying cash isn’t important! After all, good cash flow is the lifeblood of any business.)

And it’s okay and even recommended to “plug holes” when money is tight. Are there any subscriptions or services the company is under-utilizing or not utilizing at all (a.k.a. destructive expenses)?

However, companies who simply start trimming expenses indiscriminately, be it through cutting personnel or delaying initiatives or upgrades, are taking a very reactive approach to decision-making, even though many people would label their hasty actions as proactive.

This indiscriminate cost cutting can create more problems than it solves, but more fundamentally…

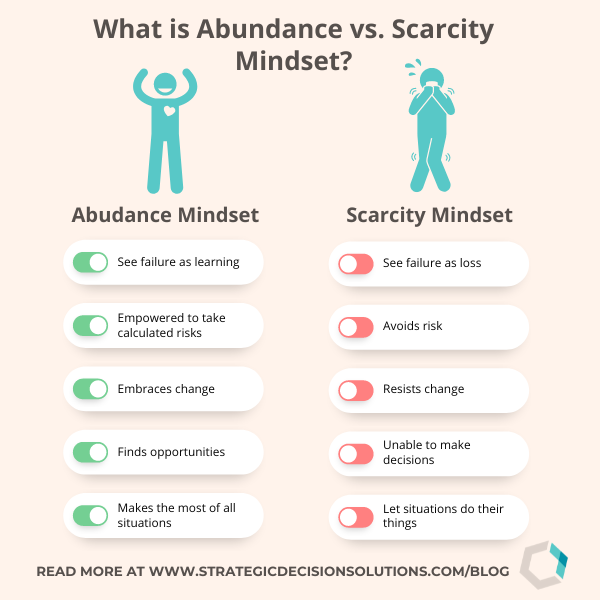

This approach is born of a scarcity mindset which can ultimately spell the demise of a company and destroy wealth.

What exactly is a scarcity mindset? I first stumbled onto this concept when attending a business development and marketing event back in the fall of 2018. One of the last speakers was Garrett Gunderson, author, founder, and Chief Wealth Architect of Wealth Factory whose mission it is to help one million entrepreneurs become economically independent.

Although he was explaining the concept of “scarcity mindset” in the context of personal finances, it can easily be applied to a company and how it allocates resources. In his book Killing Sacred Cows – Overcoming the Financial Myths that are Destroying your Prosperity, Garrett defines this concept when he writes:

Scarcity is the belief that resources are limited and the world is a stage for a zero-sum game of accumulation.”

We’re all familiar with the idea that it takes money to make money – that you have to front load costs to get to the end result. In today’s environment though, there’s a lot of uncertainty floating around, especially when it comes to the projected revenue numbers and amount of investment income a company ultimately recognizes. These are some of the first signs of trouble that trigger leadership to become uber-protective of the company’s resources rather than continuing to invest in long-term growth.

In a nutshell, this is the scarcity mindset in action.

Take the example of personnel at Canadian fintech giant Wealthsimple. Two years ago, the company was one of the few who were hiring aggressively during the pandemic, but in recent months, lackluster financial performance is prompting it to eliminate the positions of 13% of its workforce.

As I discussed in this article on the importance of ERM during troubling times, companies who lay off people en masse could end up doing more harm than good. Existing talent will not stay static until conditions improve and the company is ready to re-hire. Instead, if conditions are better in a year or two, the company will have to go to much expense to hire and train new talent, not to mention the loss of institutional knowledge, productivity, and momentum on internal initiatives.

Instead, to ensure the company keeps those with critical skill sets, an option could be offering flex scheduling and reduced hours in exchange for less salary. It may be difficult for the company to afford the full salary but offering a ½-time arrangement will allow at least some of the work to continue and therefore put the company in a stronger position when things rebound.

Honesty and transparency are critical in these situations since it is easy to get the impression the company is in real trouble. To avoid a huge exodus, reiterate the company’s mission and vision. According to surveys, employees are more likely to stick with a company whose mission they believe in, even when things are a little rough.

Surely not everyone has s scarcity mindset, right?

The opposite of the scarcity mindset is abundance, Garrett explains. Again, from his book:

How can you be more abundant? Living in the world of innovation, of value creation, of human ingenuity and looking at this impact of how do you serve more people or solve bigger problems because there’s huge payoffs in that.”

If your company chooses to take a route rooted in abundance rather than scarcity, processes and tools like risk assessment, Monte Carlo simulation, scenario planning, and others can be employed to ensure resources are being used in the most efficient ways possible.

As an entrepreneur and strategy consultant for the last six years, I can attest to the validity of this concept. Adopting a scarcity mindset leads to scrimping, saving, and a life of toil with little reward.

By contrast, adopting a mindset of abundance can help avoid this fate and ensure your company’s long-term resilience.

Has your company leadership made decisions with a scarcity mindset, only to regret them later?

The issue of mindset can often mean the difference between success and failure. To share your thoughts and experiences to help others better understand the importance of not adopting this destructive mindset, join the conversation on LinkedIn.

And if your company is struggling to understand how to best utilize its resources for maximum impact in challenging times, please don’t hesitate to reach out to me today to discuss your specific circumstances.