There are some things you just can’t put a price on.

A happy dog, breaking bread with family and friends, the sunrise on a cool, crisp morning. I could go on…

In the context of achieving objectives, and more importantly, building a competitive advantage, you just can’t put a price on a fresh perspective.

Every one of us has our own unique background – education, work, and life – plus our likes and dislikes, that all combine to shape our perspective.

In most circumstances, our own perspective is sufficient, but there are certainly times where a new or otherwise fresh perspective is really what’s needed.

Strategic planning is one area where this principle rings true.

You don’t have to be an expert to understand how Brittle, Anxious, Nonlinear, and Incomprehensible (BANI) today’s world is. Simply avoiding risks at all costs won’t cut it anymore.

Remember, when we say ‘risks,’ what we’re talking about is the effect of uncertainty on achieving objectives…this means both positive and negative effects.

Instead of avoiding risks, organizations have to be willing to raise the bar and pursue goals without a degree of certainty that was more common in the past.

As Hans Læssøe explains in his book Prepare to Dare and elsewhere, helping the company navigate extreme uncertainty and create a competitive advantage is the highest calling or potential for ERM.

We’ve previously discussed tools for gaining a fresh perspective like strategic scenarios, PESTEL, value-chain analysis.

Yet, regardless of the tools, many companies go wrong by only looking inward.

But to fully understand obstacles and opportunities between where your company is and where it wants to be, you must look outward as well.

The SWOT is a popular tool for doing a combined internal & external environmental scan, but some would argue that it’s overused and obsolete. Even though SWOT is meant to look outward, many unfortunately don’t dig deep enough to have this analysis be meaningful.

Peering outside the organization is vital. As Dr. Brad Cousins explains in this Forbes article on SWOT:

Disruptive organizations have one thing in common. They stay focused on learning outside of the organization and break the tendency to frame learning and strategy on internal strengths and weaknesses.

One such tool that focuses exclusively on the external environment and provides that fresh perspective companies need is Porter’s Five Forces analysis.

Originally developed in 1979 by Dr. Michael Porter of the Harvard Business School, the Five Forces analysis takes a macro-view of an entire industry as opposed to company-specific (i.e., ‘micro’) data and analytics.

Porter’s Five Forces is not the same as the questions for identifying top risks we discuss in a previous article.

Although PESTEL is also outward facing, it’s looking at specific drivers of risk.

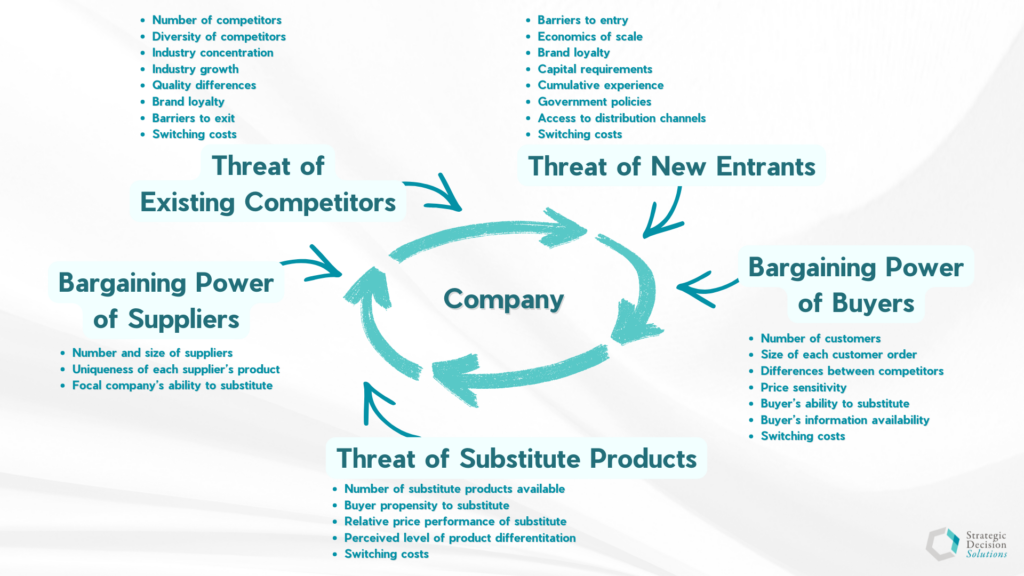

Through the Five Forces detailed below, this tool is really looking at both threats and opportunities to revenue, something that if it were to dry up, can destroy a company. Below is a graphic representation of Porter’s Five Forces.

Each of these ‘macro’ or high-level forces combine to jointly impact, positively or negatively, a company’s revenue.

Let’s say your company has a goal of entering a new market (e.g. territory or group), but you don’t have any details. The following five forces is a great option for helping decision-makers understand the nuances of that goal.

The five specific ‘forces’ that Porter’s analysis looks at are:

Force #1: Threat of new entrants

This ‘force’ is examining how easy or hard it is for someone to enter a new market. The easier it is, the greater the chance a new entrant can take market share. Conversely, the higher the barriers, the harder it will be for new entrants to impact an established company’s position.

Different barriers to entry include absolute cost advantages, access to inputs, economies of scale, brand identity, government policies, and more.

Examples of markets with higher barriers to entry: banking, insurance, or medicine.

Examples of markets with lower barriers to entry: delivery or rideshare services, towing, skilled trades in construction.

Force #2: Bargaining power of buyers

This force zeroes in on your customers and the leverage they have in your industry or product niche. If a buyer can easily shift to another seller with low or no compromise, they have greater power over sellers since they will be able to demand lower prices and higher quality, thus impacting revenue and cost of goods sold.

Also, if only a handful of buyers are responsible for the lion’s share of a seller’s revenue, they will have more power over sellers. This relationship is why it is so important to understand the number of customers a company has and how much revenue the 5 biggest customers provide.

On the other hand, consumer buying power is much lower when the customers have to depend on only one or two sellers. [cough] Utilities. 😉

Force #3: Bargaining power of suppliers

This force closely examines the power or leverage a supplier/vendor has regarding their prices. Suppliers with extensive latitude in this regard can affect a company’s revenues and its bottom line quite dramatically.

Smaller number of suppliers equals greater power of each one. Flipping the coin over – businesses (as the buyer of the supplies) will have greater power when there are more choices for suppliers or vendors in a given market.

A great example of this situation is the manufacturing of the semiconductor chip used in cell phones, computers, gaming systems, cars, etc. There is one, yes one, company that makes more than half of the world’s supply of advanced semiconductor chips. Talk about bargaining power of the supplier.

Supply chain disruptions in the last few years have showcased this reality even more, which makes robust vendor risk management all the more important.

Force #4: Threat of substitute products

Not only do customers have the option to switch to another vendor in the same space, consumers can also look at other industries all together for substitute products and services.

The more options available to a customer, the more limited your company will be in setting prices.

If there is little or no cost for the customer to change, and there are numerous substitutes to choose from, the customer will inevitably have more leverage. On the other hand, if the cost to change is high and there are few substitutes available, the company will be in the driver’s seat.

A great example of this in action is the proliferation of health and specialty drinks, something that which has come to be a threat to traditional soda similar to food brands we discuss here.

Force #5: Rivalry among existing competitors

This fifth and final force examines the intensity of competition within the niche your company is operating in or would like to break into. Since this force is influenced by the other four, it is often the deciding factor for whether a company should attempt breaking into an industry.

Rivalry is high when there are multiple businesses offering the same or similar product or service, consumers can easily switch back and forth with little to no cost, and the industry is growing.

High competition or rivalry opens the door to advertising and price wars, two things that can negatively impact company profits. Prime examples of this in action are the Burger Wars (McDonald’s and Burger King) and the Cola Wars (Coca-Cola and Pepsi).

Wrapping up…

This is a broad overview of Porter’s Five Forces. Click here for more in-depth analysis, including questions to prompt further discussion.

And if you really want to dig into not just the competition as a whole, but specific competitors in a robust way, Michael Porter’s book Competitive Strategy: Techniques for Analyzing Industries and Competitors is a great reference.

Again, today’s BANI world demands real out-of-the-box thinking and a fresh perspective on both the internal and external environment the company is operating in.

Porter’s Five Forces is one tool companies can use to gain this perspective, maintain or build their competitive advantage and pursue opportunities and objectives with confidence.

What other tools would you recommend for gaining a fresh perspective of a company’s external environment?

Please join the conversation on LinkedIn to share your thoughts.