Many, if not all, ERM thought leaders, including myself, agree that risk identification forms an essential foundation of an effective ERM process.

Taking a haphazard approach is one of several preventable mistakes companies make with risk identification that can lead to wasted time, resources, and a general loss of credibility in the minds of executives.

One area where many organizations struggle is in how to classify the risks they have identified.

This may seem like a trivial matter…

However, if risks are not categorized properly, the organization could end up over-managing ones that are relatively minor in nature or neglect ones that are true threats to operations or strategic objectives, which of course can lead to a host of consequences.

Generally speaking, risks can be broken into 3 categories or buckets. These include:

Operational – these risks consist of the day-to-day running of the business and are not associated with the strategic plan. They do not impact other areas of the organization and can be managed within the business unit in question. An example could be sufficient staffing in a call center or an outdated tool a business unit uses for its work.

Enterprise – it is possible for these risks to consist of the day-to-day business as well, but what makes them different is that they impact more than one department or have an external stakeholder like regulators, investors, or customers. Examples can include communication breakdowns between departments or information security since this issue can impact so many different areas. Many will place a risk in this category only because it was identified in a conversation with ERM or by the risk manager himself – please don’t think that ERM’s involvement in the identification of a risk automatically means it should be placed in the enterprise category.

Strategic – many use the label of strategic and enterprise interchangeably, and while they do have some overlap, they are not the same. These risks are those potential events that could prevent the organization from achieving a strategic goal or objective, regardless of whether it affects one or several departments or originates from inside or outside the organization. Let’s say part of your company’s strategy is to enter a new territory in the next year. A risk to achieving this goal could be a breakdown in shipping that prevents your product from reaching the new market.

For some risks, it’s pretty self-evident which category they should go…

Malfunctioning software or equipment in the shipping department for example will definitely fall under the operational category while shifting consumer demands in one of your target markets will likely be given the strategic label.

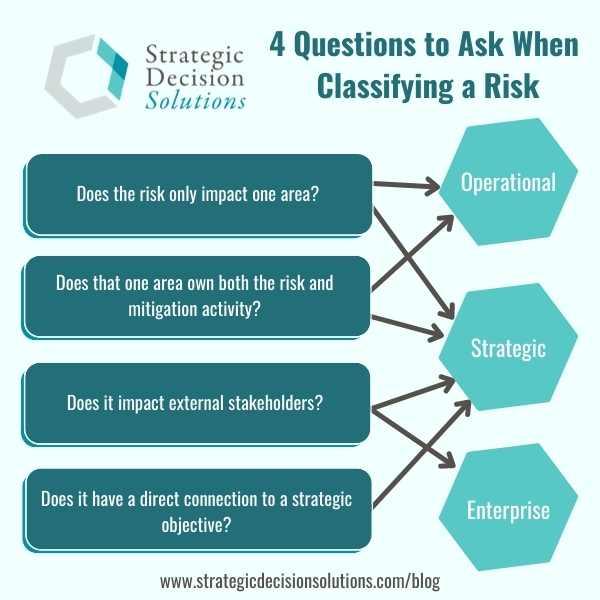

However, it can be confusing sometimes to determine which category or “bucket” a risk should go in. If you run into this situation, asking the following questions can help you find the right one through process of elimination. These include:

- Does the risk only impact one area like Marketing, Accounting, or Compliance? If yes, then it is either an operational or strategic risk, but not an enterprise one.

- Does one area or department own both the process originating the risk and the mitigation activity? If you answered yes, then it is again an operational or strategic risk, but not an enterprise one.

- Does the risk impact external stakeholders like investors, customers, or regulators? If yes, then it is an enterprise or strategic risk, but not an operational one.

- Does the risk have a direct connection to a strategic objective? If yes, then it is should be placed in the strategic risk category.

Regardless of the category you ultimately choose for a particular risk, it won’t mean anything unless it is linked to a business or strategic objective.

Up until recent years, organizations would simply generate a list of risks. The problem with this approach is that it made it difficult to know where to focus the organization’s efforts, among other issues. Consultant and author Tim Leech coined the phrase “objective-centric” ERM. He explains…

…the evidence is clear – risk list ERM was/is a seriously dangerous wrong turn that won’t support what RM should do – help companies make better decisions on the best way forward..”

For management to grasp the significance and ultimately make informed decisions, even operational risks that may seem simple must be linked to a particular business or strategic objective. A business objective is a goal developed within a given department in support of organization-wide strategic objectives.

Let’s say you’re an insurance company and have identified skyrocketing premiums as a risk. On its own, this doesn’t mean anything (in fact, most companies would like increased premiums because it leads to higher net revenue), but when linked to the goal of maintaining high retention rates, decision-makers can then better understand what may prevent them from reaching this goal.

Risk identification is about more than just saying something is a risk.

A risk must fall into one of these three categories and be linked to a strategic or business objective to be helpful for prioritizing activities and allocating funding; otherwise, no one will understand the significance of the risks to the organization.

So this begs the question…

Does your company simply list risks or do you categorize and link them to objectives?

While it may seem pretty straightforward, this question often comes up with clients and blog readers who find themselves stuck. If you have any questions or thoughts you would like to or able to share, please don’t hesitate to join the conversation on LinkedIn.

And if your company seems to be struggling with moving beyond risk lists into a more objective-focused ERM program, please feel free to contact me directly to discuss your specific situation today!