As we quickly approach the end of the year, hopefully your company has finished selecting its strategic goal(s) for 2024 and beyond.

It’s tempting at this point to think you’re done and can focus on Christmas shopping, parties and more. It’s understandable – all the workshops, meetings, risk & data analysis, and brainstorming can be exhausting…you just want to be done with it all!

This isn’t the time to get passive though – save that for when you are on vacation!

Chances are your company has struggled with transitioning from the strategic planning to implementation phase. I only say that because according to surveys cited in a past guest article in Carrier Management, execution of strategic plans is a struggle for a staggering 75% of large organizations.

It’s clear from this statistic and my personal experience that the execution, or turning plans become reality, is the tough part. Strategic planning is a significant part of setting any organization up for success, but without good implementation, these plans are nothing more than words on a hard drive or pretty presentation, or as the iconic Steve Jobs once quipped:

“To me, ideas are worth nothing unless executed. They are just a multiplier. Execution is worth millions.”

Implementing strategic goals will involve developing short-term, 1-year plans that consistent of initiatives. These plans are not the same thing as developing the goals (what) as some mistakenly believe, but instead gets into how goals will be met, which should be every bit as thorough.

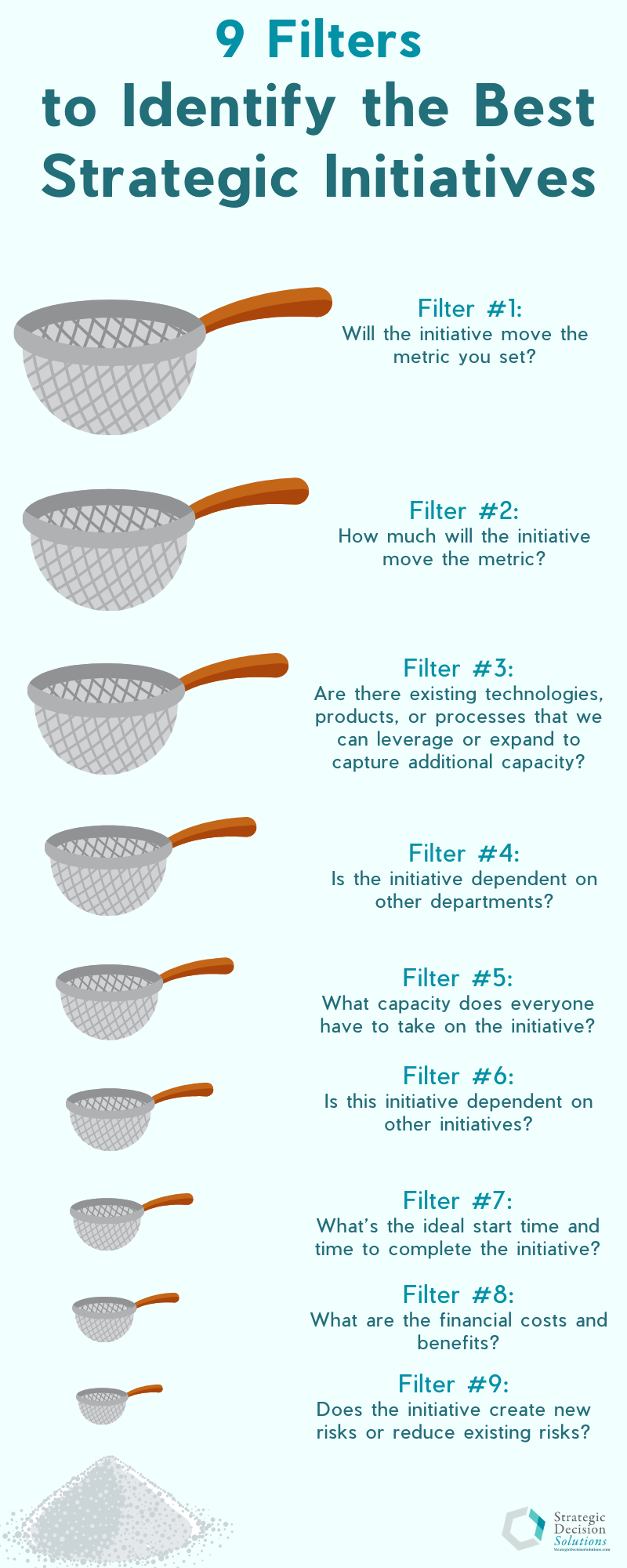

Contrary to what some likely think, a company can’t pick some random ideas for initiatives and expect everything to just magically work out. Some effort must be put into ensuring the initiatives ultimately chosen will deliver the right results. We all have ideas, which is a good thing, but a “filtering” process is needed to identify the right ideas for the right time, or to put it another way, the ones that will give you the most bang for your buck.

Kind of like an episode of American Ninja Warrior or some other elimination game show, the initiatives that make it through these filters will be the “winners” that your company will then work on in the year ahead. But unlike a game show, the ones that don’t make it through are not automatically disqualified. Some are instead shelved as a future idea – it’s not that they’re bad ideas necessarily, it’s just not the right time (more detail below). The following filters are really questions designed to challenge assumptions and ensure ideas are properly vetted.

Continue reading below to learn more about each of these stages or “filters” for screening ideas for strategic initiatives.

Filter #1 – Will the initiative move the metric you’ve set?

Before you can start collecting ideas for strategic initiatives, you must have metrics to gauge progress towards or successfully achieving the strategic goal.

If the goal is to enter a new market, a metric could be to sell 2000 units in a particular geographical area, or for a strategic goal around marketing, a metric could be growth in a certain type of follower on social media or email.

The key point when filtering initiatives is to determine if the effort will move the needle on the identified metric(s). If there is little to no impact to the metric, then what is the point of further pursuing the initiative?

Speaking of impact, the initiative must do so directly, not through “six degrees of separation.” For those who don’t know, Six degrees of separation is a theory that says any person can be connected to any other person on the planet through “…a chain of acquaintances that has no more than five intermediaries.” We can all say we’re related or know Kevin Bacon, but practically speaking, that just isn’t true.

Or maybe it is. Hmmm…

But what this means is an initiative could change one other metric or this other metric, and one of those metrics will ultimately impact the strategic goal’s success metric in a positive direction, but that doesn’t mean it should pass on to the next filter.

We can logically claim that if an effort impacts one area and goes on to impact another and another downstream, it will eventually move the needle on our primary strategic goal’s success metric. Again, practically speaking, this would be chaotic, which is why most “pet projects” likely won’t make it past this filter.

Filter #2 – How much will the initiative move the metric?

Once you have a yes/no on whether an initiative will move the needle on a metric, you then need to understand by how much. If the goal is to increase market share, the metric could be to increase sales of product A by 2000 units, or by 30% over the last year. One particular initiative may accomplish 50% of this metric in 6 months while another may accomplish 30% in the same amount of time. Which would be the better option for the company?

The goal for this filter isn’t necessarily to eliminate a particular initiative, but rather to understand just how much one idea will move the needle as this will play into some of the other filters.

A word of caution – projections like these need to be about more than just pulling numbers out of thin air (talk about guess-timating!) but should rather be based on actual forecasting. After all, we need to be held accountable to the forecasts down the road.

Filter #3 – Are there existing technologies, products, or processes that we can leverage or expand to capture additional capacity?

The filter is putting the concept of “work smarter, not harder” into practice. Like Filter #2, this doesn’t necessarily eliminate an initiative if the answer is no, nor does it automatically mean one will make the cut if the answer is a resounding yes for reasons that should hopefully become clear as we go along.

Answering yes simply means there are tools in the company that can be repurposed for this particular need, thus saving business units from having to “reinvent the wheel” each time or otherwise start from scratch, both of which can ultimately impact other filters below on cost and time to completion.

Using our example of growing market share, is there any existing equipment that can be used or re-purposed to support more production? Or will it require completely new machinery? How versatile is this new machinery or technology? Will it be useful for other initiatives down the road?

Filter #4 – Is this initiative dependent on other departments?

This filter is a great example of the importance of timing and order. Since this filter will inform other critical ones, you can try to ask it later in the sequence, only to realize that based on the answer, you will have to revisit some of the filters. Who wants to waste time? Not me!

This question is critical because of the fact many companies will just go and start initiatives without consulting implementers or doing this level of due diligence. What often happens in these cases is work will have to be paused for an unknown period of time because another department, whose expertise is needed, is unable to step-in at the appropriate time.

If an initiative can be done within one department, then this particular filter is unnecessary. However, in my experience, anything big enough to be considered an initiative will be cross-departmental.

Take a consumer outreach initiative as an example. It may sound simple on the surface, but chances are it’s going to need to involve multiple departments like marketing, IT, or customer service.

Once all the different departments have been identified, it then becomes a question of capacity.

Filter #5 – Do the necessary resources have sufficient capacity to work on the initiative?

The next filter takes things a little deeper to identify specific people and skill sets needed to pursue the initiative and their capacity to do so effectively. The fact is everyone is (…or at least should be) busy with their day-to-day responsibilities and therefore simply may not have the capacity to take on another project, at least not right now. This will play into a later filter on timing.

It’s not just about a specific department, but individual(s) with the skill sets or subject matter expertise that will be needed to complete the initiative. If they do not have the capacity, is it possible to take something away to give them more? If that is not possible, is the company willing to enlist outside help? Doing so will mean incurring additional costs or adding to the schedule, which both will need to be considered.

Filter # 6 – Is this initiative dependent upon other initiatives?

Similar to the last two filters, another part of evaluating an initiative is to understand its dependance on other initiatives. The thing with initiatives – most people are excited or really eager to get started. At least, that’s the case with companies with healthy cultures. I compare it to the starting line of a race, like this one where my son competed earlier this year.

They just couldn’t wait to start…inching up on the starting line and off like lightning as soon as “go” was yelled. 🙂

Like so many of the other filters though, we want to make sure the cart is not being put before the horse. What often happens in the context of this filter is a new initiative will commence, but two months in, work has to be paused because there’s another initiative or some other critical system/process that needs to be in place.

This unexpected pause in the work can really throw sand in the gears of the cost and timing of the initiative, as well as day-to-day operations…and can be especially messy if outside help needs to be brought in to augment capacity or knowledge.

Therefore, before letting the kids run off the starting line, make sure there aren’t pieces from other initiatives that need to be in place to complete the initiative being evaluated.

Filter #7 – What’s the ideal start time and time to complete the initiative?

Understanding all the dependencies for an initiative will enable you to better gauge both start time and time to completion. As the previous filters have hopefully demonstrated, having a clear understanding of an initiative’s scope doesn’t automatically mean the project can get underway immediately. Other projects may need to be completed first or some other tools, technology, and resources will need to be in place.

For our market share example from earlier, one initiative may exceed the metric by a long shot but will not start for 6 months and will take a year to complete. On the other hand, initiative B may only accomplish half the metric but can commence immediately and be done in 3 months.

It’s at this point that initiatives may start being eliminated again. This filter may show that a particular option may really move the needle on the metric, but it has so many dependencies that it can’t be started for 6-8 months and will take over a year to complete. This delay in starting combined with the length to complete the initiative means it will be over 18 months before the company will see any results. It’s not that the initiative is a bad idea; it just isn’t the best idea to get results faster and likely with fewer resources. At this point, either strike the initiative off the list or add it to the “parking lot” list to be considered next year.

Filter #8 – What are the financial costs and benefits?

After timing, the next filter a proposed initiative will need to pass through will be costs and benefits. The previous filters on dependencies and timing will help inform the costs of an initiative. However, the estimates on both costs and benefits should be more than a guess, but rather a projection or forecast based on any and all reasonably available information.

Using our market share example again, if the costs are going to equal or exceed the amount of revenue the product(s) will bring in, then decision-makers will need to decide if the initiative is worth it. If the costs are one-time or temporary to get the product(s) or service(s) to market and the revenues are expected to increase over time, then it may be worth it.

However, these examples are just tangible costs and benefits, which is only half the equation.

Intangibles like reputation will have to be considered as well, which as discussed here, constitute an increasing share of a company’s overall value. Therefore, the company needs to also determine the intangible impact(s) an initiative could/should have as well, both positively and negatively. Intangible cost examples are opportunity cost – having to use a resource for this initiative instead of other work being done, whether technology, sales staff, or a manufacturing supplier. Intangible benefits examples include customer satisfaction (use a metric like Net Promoter Score) or employee satisfaction (use a metric like employee engagement score). While these are intangible, they do have an indirect impact on the tangibles like revenue and expenses.

It’s through this process that the company determines the initiative’s financial cost and benefit is acceptable but could lead to reputation damage through prolonged or negative social media chatter, making the initiative too risky. In the past, a company would have time to get ahead of something negative, but today, the consequences can be felt immediately and more forcefully, which is why companies must consider the intangible costs and benefits just as closely as tangible ones.

Filter #9 – Does the initiative create new risks or reduce existing risks?

The last thing that needs to be taken into account when evaluating an initiative is whether it will introduce new risks, exacerbate existing ones, or reduce those risks that exceed acceptable levels. As with the strategic planning process itself, this is where ERM can be especially helpful since it should have its finger on the pulse of the company’s threats and how a particular initiative could impact them.

If the initiative is creating new risks, is that acceptable? At what point would it become unacceptable? Questions like these are when tools like risk appetite and risk tolerance can be useful.

These risks can include anything from regulations to technology, vendors, financial, and more. If the initiative is about introducing a new software, how will it integrate with existing technology? How will it impact IT security and are we okay with that? Will triggering or exacerbating any of these risks put us out compliance with relevant laws?

After all, an initiative may hit all of the points of the previous filters but is simply too risky to pursue. This isn’t to imply ERM should be a naysayer, but rather ensure decision-makers fully understand the risks they’re taking…

As stated by Hans Læssøe and other thought leaders, companies have to be willing to take informed risks to move the company forward.

If it hasn’t been done already, this is a prime opportunity for making sure risks are linked to specific strategic and business objectives.

Coming to a Conclusion

These are the foundational questions that should be asked by every company. Recognize that there could or will be other questions depending on the company, industry, etc., and it’s possible that these additional questions will eliminate more initiatives.

This filtering process has to be done for each initiative. Yes, every single initiative.

Only if an initiative makes it through all of these filters (plus any added by the company) can it then be included on the current year’s list.

With the initiatives that did make the cut, further analysis using Gantt charts, dependency mapping, and other tools should be conducted to see the big picture when it comes to resourcing and timing.

It should hopefully be clear that choosing initiatives to focus on is not entirely about metrics, although they are important. An initiative may hit it out of the park in this regard, but if it’s unwieldy, involves many departments, and will take a long time to complete, it may ultimately be scrapped for another one that only moves the metric by half but is way simpler to execute.

The more complex initiatives have more opportunities for failure, but companies can move forward with confidence after this filtering process.

In the end, the purpose of doing all of this is prioritization, allocation of resources, and overall informed decision-making. The filtering process outlined above can help ensure the initiatives a company ultimately pursues are the right fit at the right time.

No company has unlimited time and financial resources to pursue everything it wishes. As with setting strategic goals, choices will have to be made on how goals will be accomplished. In my experience, 3-4 simultaneous initiatives are about the most a mid-sized company can handle. Otherwise, attention gets too diluted to make solid, positive progress.

Does your company use any sort of filtering process to determine which strategic initiatives it will take on?

Would you include any additional questions or parameters?

This is a timely topic, so any insights will be helpful to fellow risk and strategic planning professionals. You can share your insights in the comments section below or join the conversation on LinkedIn.

And if your company has developed strategic goals but is stuck on determining how to best pursue them, please don’t hesitate to reach out to discuss your specific trouble spots and options for getting unstuck.